Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

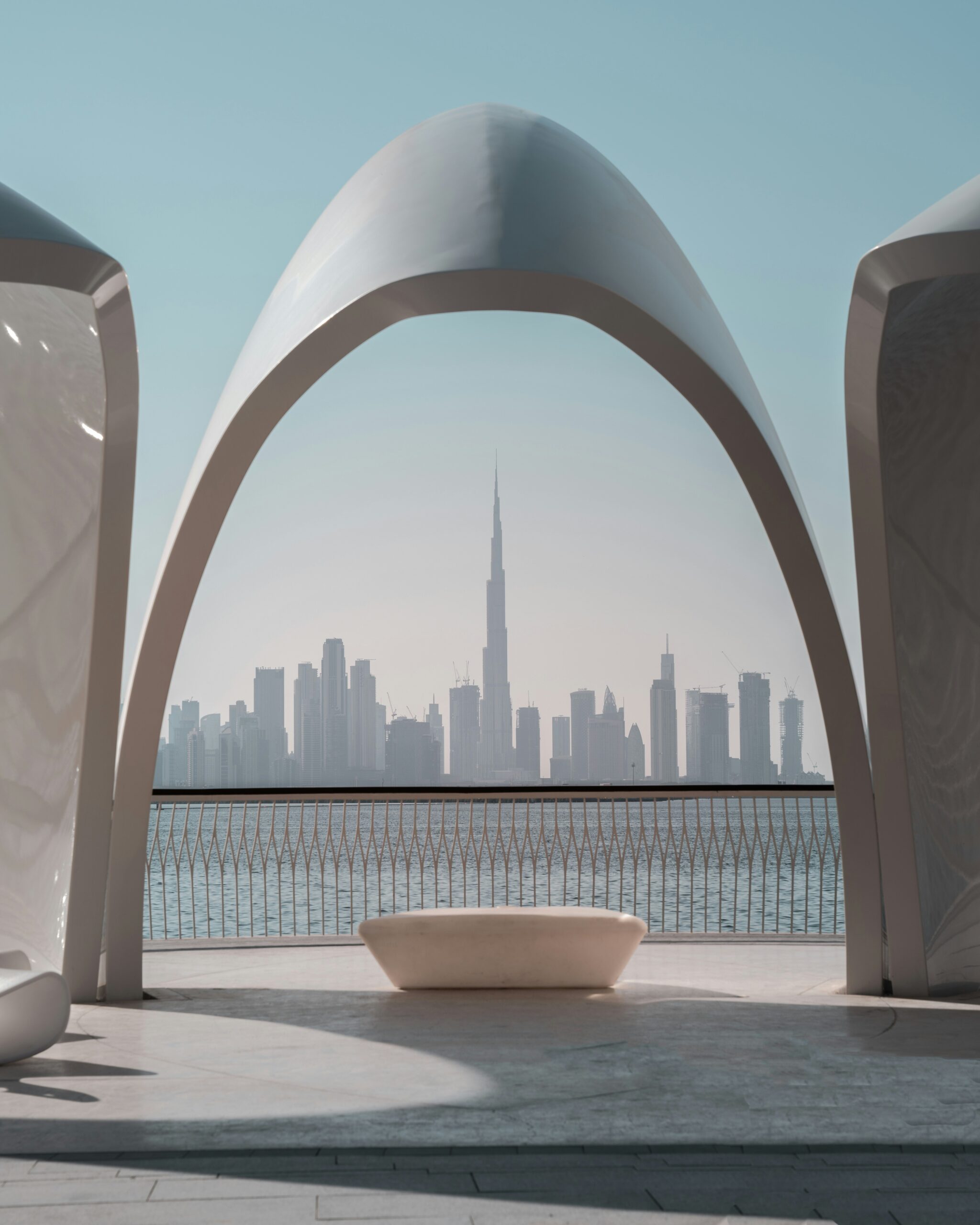

Dubai is synonymous with ambition. The skyline is a testament to what happens when vision meets capital, creating one of the most dynamic property markets on the planet. For investors, the allure is undeniable: high yields, tax efficiencies, and a luxury lifestyle that attracts high-net-worth individuals from every corner of the globe. However, this rapid growth often blurs the line between strategic investment and mere speculation.

Too often, capital is deployed based on hype rather than hard data. An investor might buy a plot or an off-plan unit simply because a district is “trending,” hoping that market momentum will deliver a return. This is speculation. Smart investing, conversely, relies on professional underwriting—a disciplined, mathematical approach to determining the true viability of a project before a single dirham is spent.

In a market as volatile as Dubai, the difference between a successful exit and a stalled project often comes down to the rigour of the underwriting process. This article explores how professional analysis separates gambling from genuine wealth creation.

At its simplest, underwriting is the process of verifying that the numbers work. It goes beyond the glossy brochures and sales pitches to assess the financial health and potential risks of a real estate opportunity.

In the context of Dubai joint venture projects, professional underwriting acts as the project’s immune system. It identifies potential threats—be it construction cost inflation, regulatory changes, or market saturation—and creates a plan to mitigate them. It shifts the focus from “what could this be worth?” to “what does it cost to build, how long will it take, and what is the conservative exit price?”

For landowners and developers, this means moving away from gut feelings. A properly underwritten project relies on disciplined financial modelling that stress-tests assumptions. If occupancy drops by 10%, is the project still solvent? If material costs rise by 5%, is the margin still attractive? Smart investing demands that these questions are answered upfront.

The Dubai market is flooded with opportunities, but not all plots are created equal. A prime location in a fast-growing district is only valuable if the development built upon it aligns with market demand.

Firms like Mafhh approach this through in-depth market analysis and feasibility studies. Before a joint venture is structured, the team validates the land’s potential. This involves analyzing supply and demand metrics in specific neighbourhoods—whether that is Business Bay, JVC, or emerging waterfront communities.

By using data to validate a plot, investors avoid the trap of building the wrong product in the right location. For instance, constructing ultra-luxury residences in a district better suited for mid-market yields is a common error that underwriting prevents. Feasibility studies ensure that the proposed development—whether residential, commercial, or mixed-use—matches the demographic and economic reality of the area.

Successful project delivery is rarely an accident; it is the result of a granular underwriting process that accounts for every variable. This phase involves assembling the right team and scrutinising the budget.

A spreadsheet can look profitable, but if the execution team fails, the project fails. Professional underwriting includes vetting the consultants, architects, and contractors who will bring the vision to life. It assesses their track record, financial stability, and capacity to deliver on time.

Time is money, especially in real estate development where financing costs accrue daily. A robust underwriting process establishes realistic budgets and timelines. It builds in contingencies for delays, ensuring that the project remains viable even if hurdles arise. This level of precision is critical for maintaining investor confidence throughout the lifecycle of the build.

Are we selling off-plan? Are we holding for yield? Are we selling the entire asset to an institutional buyer? Underwriting defines the exit strategy before the ground is broken, ensuring that the project is designed to appeal to the ultimate end-user or buyer.

Joint ventures (JVs) are a powerful vehicle for real estate development in Dubai, often uniting a landowner with a developer and investors. However, these partnerships introduce complexity.

Professional underwriting is the glue that holds these deals together securely. By clearly defining the contributions and expected returns of each party, underwriting fosters transparency.

Strategic partnerships, like those facilitated by Mafhh, rely on secure agreements and legal compliance. By structuring deals with clarity, all stakeholders are protected against disputes, ensuring the focus remains on project delivery and profitability.

The modern underwriting process in Dubai is supported by a growing ecosystem of data and regulatory frameworks. Smart investors utilise this ecosystem to make evidence-based decisions.

Platforms such as Smart Crowd, Stake, and Realist AI provide granular data on transaction histories, rental yields, and price trends. This democratisation of data allows for more accurate benchmarking. Underwriters use these tools to validate their assumptions against broader market performance.

The Dubai International Financial Centre (DIFC) offers robust frameworks for structuring property holdings. Utilising DIFC Foundations or Property Holding Companies can provide tax efficiencies and asset protection, adding another layer of security to the investment.

Furthermore, regulated wealth platforms allow for investment-grade opportunities that have already passed stringent due diligence. Leveraging these institutional-grade structures ensures that the investment is built on a solid legal footing.

Consider the trajectory of a typical joint venture project facilitated by rigorous underwriting.

The Scenario: A landowner possesses a prime plot in a developing corridor but lacks the liquidity to build. Speculation would suggest selling the land for quick cash or partnering with the first developer who offers a high percentage.

The Underwritten Approach:

In a city as fast-moving as Dubai, the fear of missing out can often cloud judgement. However, the most successful portfolios are not built on luck; they are built on logic.

Professional underwriting is the ultimate safeguard. It provides the transparency required to navigate complex joint ventures and the discipline needed to maximize returns. By partnering with experts who prioritise feasibility studies, rigorous budgeting, and market validation, you transform real estate from a high-stakes gamble into a calculated, profitable business.

Whether you are a landowner looking to unlock value or an investor seeking exposure to the Dubai market, demand to see the underwriting. It is the blueprint of your success.